can i get the child tax credit if my child was born in december

To be a qualifying child for. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States.

What Is The Additional Child Tax Credit Turbotax Tax Tips Videos

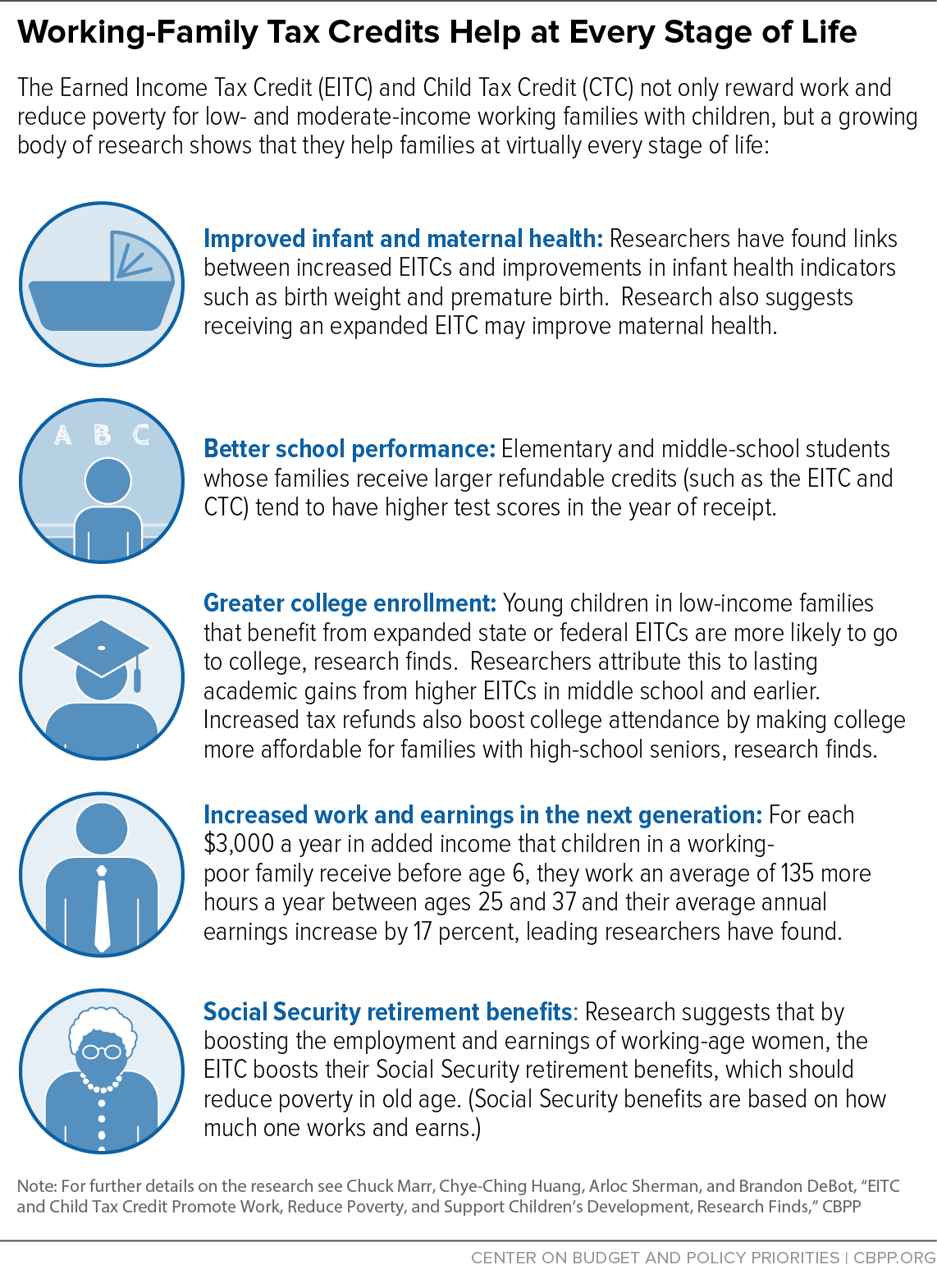

Many families had the option of receiving advance payments of the child tax credit from July through December 2021.

. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Even though the IRS would give credit for the entire year since he was born in March he has not lived with. Parents of any baby born in the US.

Will i get the child tax credit if i have a baby in december. 9 Possible Reasons You Didnt Get. Parents do not need to have earned income or a job to claim the.

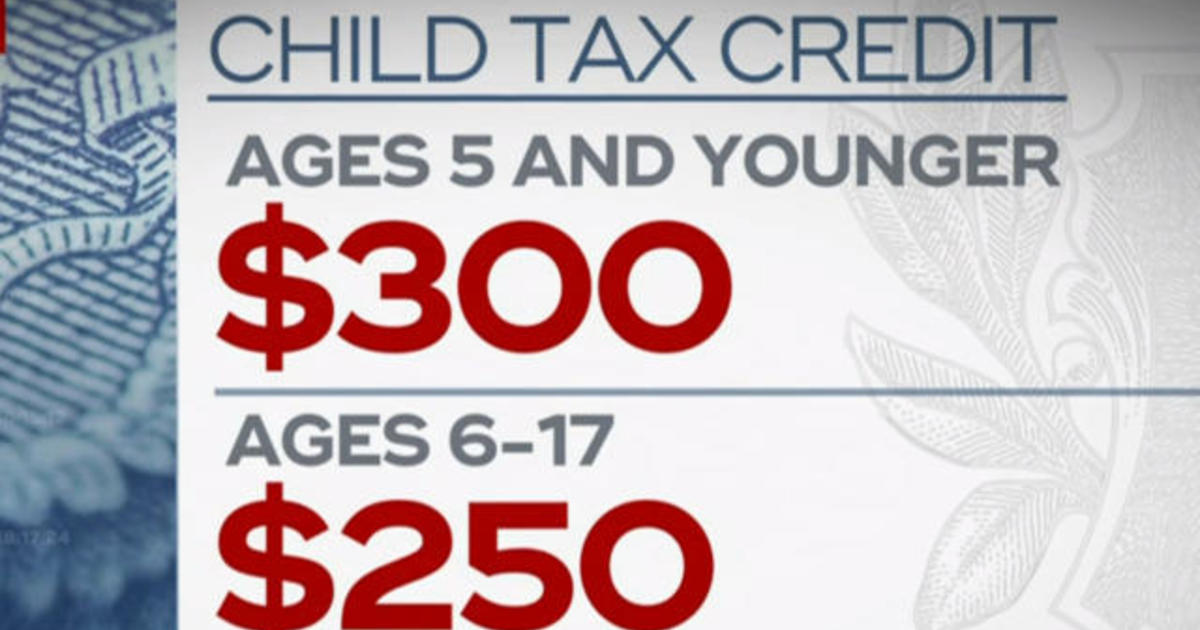

The maximum benefit amount is 3600 for each qualifying child under the age of six lessening for children aged 6-17. But as payments are now. For any dependent child who is born or adopted in.

For any dependent child who is born or adopted in 2021 or who was not. A childs eligibility is based on their age on December 31 2021. Can I still qualify if my child is born or adopted this year.

Can you get child tax credits if born in 2021. 1200 sent in April 2020. 150000 for a person who.

If instead your child is born in December then the entire 3600 credit will just be applied as a lump sum at tax season. If you had a baby you may qualify for a credit up to 3600. Half of this benefit 1800 was paid out in six monthly.

The child tax credit requires that you provide a valid ssn for your qualifying child. Can i get the child tax credit if my child was born in december. If you have a newborn child in December or adopt a child you can claim up to 3600 for that child when you file your.

Do you get child tax credits if born in 2021. A childs eligibility is based on their age on December 31 2021. When is the latest date a child can be born in the tax year to qualify as your dependent for tax purposes.

Enhanced child tax credit. You might be surprised by the answer. No he does not qualify as a dependent nor for the Child Tax Credit.

How to Get Your Child Tax Credit Money If You Had a Newborn or Adopted Since Last Filing Your. During 2021 can claim the child tax credit. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021.

There isnt a limit on the number of children who can possibly get expanded child tax credit.

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

Child Tax Credit Here S What To Know For 2022 Bankrate

Publication 596 2021 Earned Income Credit Eic Internal Revenue Service

Child Tax Credit 2022 How To Receive A 5000 Tax Refund If You Re A New Parent Marca

Payments From The Expanded Child Tax Credit Are Being Sent Out Npr

How To Get Child Tax Credit Payments If You Don T File A Tax Return Kiplinger

The 2021 Child Tax Credit Implications For Health Health Affairs

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

Child Tax Credit Payments What To Expect In 2022 And How Much Nbc New York

Eitc And Child Tax Credit Promote Work Reduce Poverty And Support Children S Development Research Finds Center On Budget And Policy Priorities

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Why Some Families May Have To Repay 2021 Child Tax Credit Payments

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

2021 Child Tax Credit Advance Payments Claim Advctc

Child Tax Credit 2021 8 Things You Need To Know District Capital

5 Things To Know About Irs Letter 6419 Taxes And The Child Tax Credit

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Irs Parents Of Children Born In 2021 Can Claim Stimulus As Recovery Rebate Credit Wjet Wfxp Yourerie Com

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News